All Categories

Featured

You will now require to search for the "unpaid tax obligation" line for the prior tax obligation year to figure out the amount to sub-tax. A redemption declaration is an additional resource made use of to figure out sub-tax acquisition amounts. That amount, plus the $5.00 fee, is the overall amount necessary to sub-tax. Personal and company checks are accepted.

Property can be a rewarding financial investment, however not everybody wants to take care of the troubles that often include owning and keeping rental property (is tax lien investing a good idea). One method to buy property without being a property owner is to acquire building tax liens. Every year, property owners in the U.S. fall short to pay concerning $14 billion in real estate tax, according to the National Tax Lien Organization

Tax Lien Investing Risks

When a house owner drops behind in paying residential or commercial property taxes, the area or municipality may put tax obligation lien versus the building. This ensures that the residential or commercial property can not be refinanced or offered till the taxes are paid. Rather than waiting for payment of tax obligations, federal governments often determine to sell tax lien certificates to exclusive financiers.

As the owner of a tax obligation lien certification, you will receive the passion payments and late costs paid by the home owner. If the homeowner does not pay the taxes and penalties due, you have the lawful right to confiscate on and take title of the home within a certain duration of time (normally two years). So your earnings from a tax lien financial investment will certainly originate from either sources: Either interest repayments and late costs paid by home owners, or repossession on the home in some cases for just pennies on the dollar.

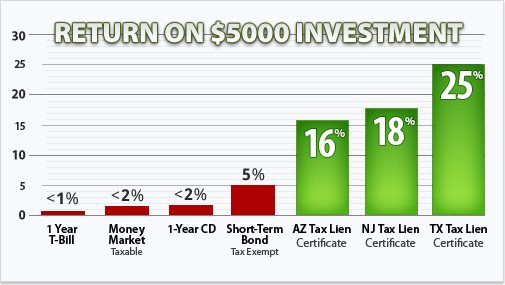

The rate of interest rate paid on tax obligation liens varies by state, but it can be as high as 36 percent annually. Another benefit is that tax obligation lien certifications can in some cases be purchased for just a couple of hundred dollars, so there's a reduced barrier to access. You can diversify your portfolio and spread out your risk by buying a number of various tax obligation lien certificates in different genuine estate markets.

For instance, if the house owner pays the interest and charges early, this will certainly reduce your return on the financial investment (tax lien investing risks). And if the house owner proclaims personal bankruptcy, the tax obligation lien certification will be subordinate to the home loan and government back taxes that are due, if any. An additional danger is that the value of the domestic home can be less than the amount of back taxes owed, in which instance the homeowner will certainly have little reward to pay them

Tax lien certifications are typically marketed by means of public auctions (either online or face to face) performed annually by area or municipal taxing authorities (tax lien investing books). Available tax liens are commonly published numerous weeks before the auction, along with minimal proposal quantities. Examine the web sites of areas where you're interested in acquiring tax liens or call the area recorder's office for a checklist of tax lien certificates to be auctioned

Tax Lien Investing Florida

Keep in mind that a lot of tax obligation liens have an expiry day after which time your lienholder legal rights end, so you'll need to relocate quickly to enhance your possibilities of optimizing your investment return. Tax obligation lien investing can be a successful method to invest in property, yet success needs thorough research study and due persistance

Firstrust has even more than a years of experience in providing financing for tax obligation lien investing, along with a committed team of qualified tax obligation lien specialists that can help you leverage potential tax lien spending opportunities. Please contact us for more information about tax obligation lien investing. FT - 643 - 20230118.

Latest Posts

Mortgage Overage

Back Owed Property Taxes

Homes For Back Taxes