All Categories

Featured

Table of Contents

- – What is the process for investing in Real Esta...

- – How does Commercial Property Investments For A...

- – What is Real Estate Investment Networks For A...

- – Commercial Real Estate For Accredited Investors

- – What is the most popular Commercial Real Est...

- – Are there budget-friendly Residential Real E...

Rehabbing a house is taken into consideration an energetic financial investment method - Accredited Investor Real Estate Partnerships. You will certainly be in fee of coordinating improvements, managing specialists, and inevitably making sure the building sells. Energetic approaches need even more effort and time, though they are connected with big earnings margins. On the various other hand, passive property investing is excellent for investors who desire to take a much less engaged strategy.

With these methods, you can enjoy passive revenue with time while enabling your investments to be managed by somebody else (such as a building monitoring business). The only point to remember is that you can lose on some of your returns by hiring someone else to handle the investment.

An additional factor to consider to make when selecting a real estate spending approach is straight vs. indirect. Similar to energetic vs. passive investing, straight vs. indirect describes the level of participation called for. Direct investments involve actually acquiring or taking care of buildings, while indirect strategies are much less hands on. For example, REIT spending or crowdfunded buildings are indirect realty financial investments.

Register to participate in a FREE online property course and discover just how to start purchasing realty.] Numerous capitalists can get so captured up in recognizing a property type that they do not understand where to begin when it comes to finding a real residential property. So as you familiarize yourself with various residential property kinds, also make sure to learn where and how to discover every one.

What is the process for investing in Real Estate Crowdfunding For Accredited Investors?

There are heaps of residential or commercial properties on the market that fly under the radar because financiers and property buyers don't know where to look. A few of these residential or commercial properties experience inadequate or non-existent marketing, while others are overpriced when listed and therefore stopped working to obtain any type of focus. This indicates that those financiers going to sort via the MLS can find a range of financial investment chances.

In this manner, capitalists can continually track or be notified to brand-new listings in their target area. For those questioning just how to make connections with realty representatives in their corresponding areas, it is an excellent concept to attend regional networking or property occasion. Capitalists looking for FSBOs will certainly also find it beneficial to collaborate with a genuine estate representative.

How does Commercial Property Investments For Accredited Investors work for high-net-worth individuals?

Investors can likewise drive via their target areas, searching for indications to discover these residential properties. Bear in mind, recognizing buildings can take time, and financiers must be prepared to employ numerous angles to secure their next deal. For investors staying in oversaturated markets, off-market buildings can stand for a possibility to obtain ahead of the competition.

When it comes to looking for off-market properties, there are a couple of sources investors should inspect. These include public records, real estate auctions, wholesalers, networking occasions, and contractors.

What is Real Estate Investment Networks For Accredited Investors?

Years of backlogged repossessions and boosted motivation for financial institutions to reclaim could leave also extra foreclosures up for grabs in the coming months. Investors browsing for foreclosures need to pay careful attention to newspaper listings and public documents to find prospective residential or commercial properties.

You must think about investing in genuine estate after learning the different benefits this asset has to supply. Generally, the consistent need offers genuine estate reduced volatility when compared to other financial investment types.

Commercial Real Estate For Accredited Investors

The reason for this is due to the fact that actual estate has low relationship to various other financial investment kinds hence offering some securities to capitalists with other possession kinds. Various kinds of realty investing are associated with various levels of threat, so make sure to find the ideal investment method for your goals.

The process of buying residential or commercial property entails making a deposit and financing the remainder of the price. Consequently, you only pay for a little portion of the building up front however you manage the entire investment. This form of leverage is not readily available with various other financial investment types, and can be used to additional expand your investment profile.

Nonetheless, due to the vast range of alternatives offered, many investors likely locate themselves questioning what truly is the very best realty investment. While this is an easy concern, it does not have a basic solution. The ideal kind of financial investment property will certainly rely on many variables, and capitalists ought to be careful not to rule out any choices when looking for prospective bargains.

This write-up checks out the possibilities for non-accredited investors aiming to venture into the financially rewarding world of realty (Commercial Real Estate for Accredited Investors). We will explore numerous financial investment avenues, regulatory considerations, and techniques that encourage non-accredited individuals to harness the possibility of genuine estate in their financial investment portfolios. We will certainly likewise highlight exactly how non-accredited financiers can function to become accredited capitalists

What is the most popular Commercial Real Estate For Accredited Investors option in 2024?

These are usually high-net-worth individuals or companies that meet accreditation requirements to trade private, riskier financial investments. Earnings Requirements: People need to have a yearly income surpassing $200,000 for two consecutive years, or $300,000 when incorporated with a partner. Net Worth Requirement: An internet worth going beyond $1 million, leaving out the key home's value.

Financial investment Understanding: A clear understanding and awareness of the dangers connected with the financial investments they are accessing. Documentation: Capacity to offer monetary declarations or other paperwork to confirm income and web well worth when asked for. Real Estate Syndications require recognized capitalists because enrollers can only enable recognized investors to sign up for their financial investment possibilities.

Are there budget-friendly Residential Real Estate For Accredited Investors options?

The very first usual false impression is when you're an accredited capitalist, you can keep that status indefinitely. To become a recognized investor, one should either strike the earnings requirements or have the internet worth requirement.

REITs are eye-catching since they generate more powerful payments than conventional supplies on the S&P 500. High return rewards Profile diversification High liquidity Rewards are taxed as average earnings Level of sensitivity to rates of interest Dangers related to specific homes Crowdfunding is a technique of online fundraising that includes requesting the general public to contribute cash or start-up capital for brand-new tasks.

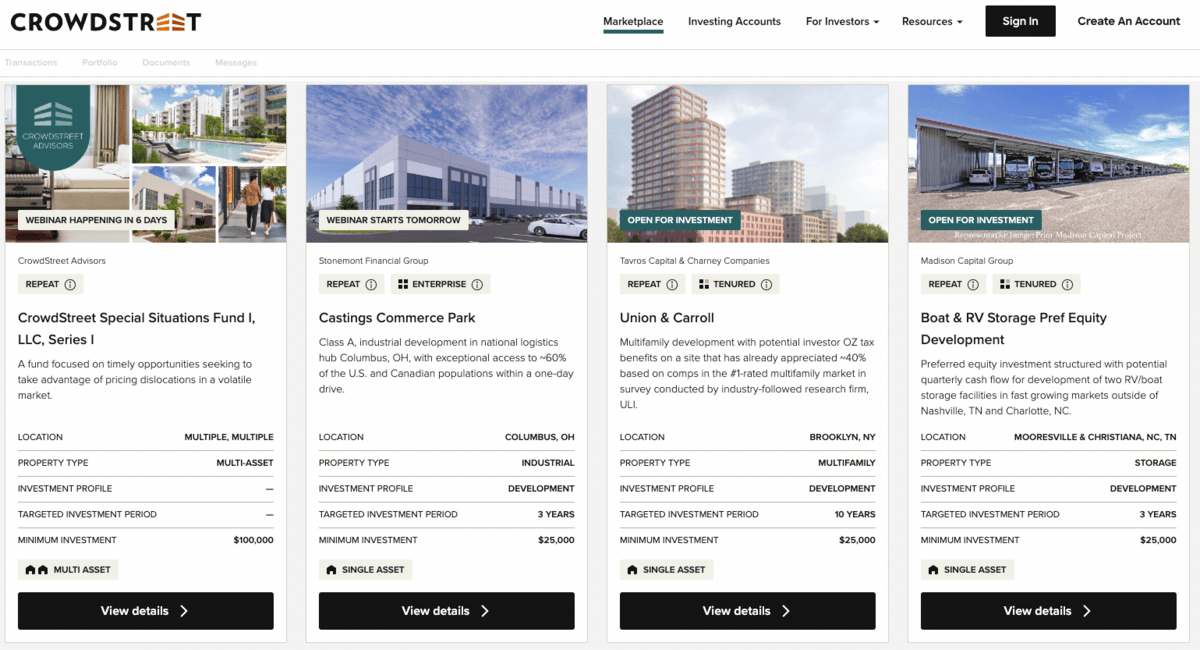

This permits entrepreneurs to pitch their ideas straight to daily internet individuals. Crowdfunding supplies the capability for non-accredited financiers to come to be investors in a company or in a property building they would certainly not have actually had the ability to have access to without accreditation. An additional advantage of crowdfunding is profile diversity.

The 3rd benefit is that there is a reduced barrier to access. Sometimes, the minimum is $1,000 bucks to buy a business. In numerous situations, the financial investment candidate requires to have a track document and is in the infancy stage of their job. This might imply a higher danger of shedding an investment.

Table of Contents

- – What is the process for investing in Real Esta...

- – How does Commercial Property Investments For A...

- – What is Real Estate Investment Networks For A...

- – Commercial Real Estate For Accredited Investors

- – What is the most popular Commercial Real Est...

- – Are there budget-friendly Residential Real E...

Latest Posts

Mortgage Overage

Back Owed Property Taxes

Homes For Back Taxes

More

Latest Posts

Mortgage Overage

Back Owed Property Taxes

Homes For Back Taxes